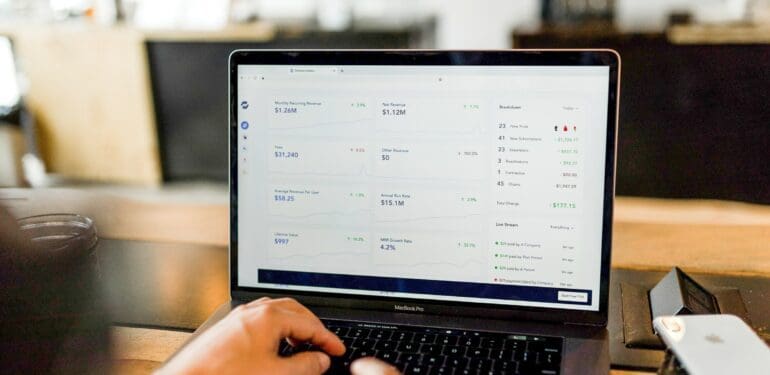

In the most basic sense, a financial performance dashboard provides you with a visual snapshot of the performance of your business via a straightforward interface. It is a handy tool when it comes to ensuring that your business is meeting its core objectives.

A financial dashboard will connect to all of your accounting and business systems so that all of your data collaborate in one place for complete visibility. You can then implement Key Performance Indicators (KPI). This gives you the ability to measure the performance of your business per your business objectives. You will be able to spot any KPIs that are failing in your KPI dashboard and make the necessary adjustments. You can also make financial decisions. For example, if you’re thinking of heading to the likes of Riley Ford Inc to add to your fleet, you can use your dashboard first to determine the impact this will have on your business.

For your financial dashboard to be successful, you must adhere to some core philosophies. For example, your strategy and your objectives need to be precise. Aside from this, you need to have a meaningful annual budget, and this must be aligned to your strategic objectives and based on business drivers. A dashboard will not be effective if you do not implement effective KPIs that are linked to your strategic goals. It would be best to choose your KPIs with care to ensure you measure the most vital aspects of your business’s performance. Finally, relevant monthly information must be produced in a timely and concise manner. All in all, you will be able to monitor business risks through forecasts and KPIs, including key business drivers, cash flow, solvency tests for dividends, and bank covenants.

Photo by Austin Distel

Experience Huge Time Savings With A Financial Dashboard

If you want to boost the financial performance of your business, one option you may be considering is a financial reporting dashboard. This software consolidates all of your data on the one interface for full visibility, giving you the ability to make better decisions. However, it can also save you a considerable amount of time. Read on to discover more.

Small companies often have to get more done with less because they do not have the resources that large corporations do. However, a financial dashboard can put smaller businesses on more of a level playing field. Your employees will be able to focus on more important and profitable tasks because they will automate the reporting process, which would have been done manually before. Instead, reports can be generated at the click of a button, which saves a significant amount of time.

From cashflow reports to financial KPI reports, you will be able to automate a whole host of useful management reports that will give you accurate and instant insights about your business. This eradicates the need to sift through vast amounts of information and data to get what is often a simple answer. Instead, you will be able to react instantly and make the necessary decisions to improve your business. All in all, with real-time reports, you can save time, boost productivity, and utilise the information and data to enhance your company’s performance.

Financial KPI Dashboards

A high revenue growth rate, a large net profit margin, and an impressive return on investment (ROI) are all desirable financial characteristics of any business. They are also Key Performance Indications (KPI). KPIs are a critical part of any company aiming for success. With a financial KPI dashboard, you can measure, monitor and manage performance using KPIs to make intelligent decisions regarding what needs to be improved.

KPIs are an invaluable form of business intelligence. They present business owners with a set of measures that allow them to focus on organisational performance aspects that are the most vital to the success of their business, both now and in the future. However, it takes a lot of time and energy to monitor, manage, and analyse these indicators. The most critical aspect is ensuring that your KPIs are relevant. To do this, you need to establish that the KPI needs to be frequently measured. Moreover, you must respond to the outcomes predicted by the indicators to ensure improvements are made.

Once you have established your KPIs, a KPI dashboard can help you to monitor them. This will give you the ability to see how you are performing by the indicators you have set. You will see if your KPIs are failing or succeeding. A financial dashboard will ensure better results are achieved, as the right users will get the correct information at the right time. This ensures better decision-making, which means that amendments can be made at a rapid pace to deal with any failing KPIs.

How To Identify Successful KPIs For Your Dashboard

When using financial reporting software, one of the most important steps is identifying effective Key Performance Indicators (KPIs) for your business. If you do not set realistic and relevant aims and KPIs for measuring these goals, you will never have a true reflection of how your business is performing. With that being said, read on to discover how to identify successful KPIs.

The truth is that you can use your business’s reporting software as a starting point for determining what KPIs to implement. This is because your solution will give you the ability to review large quantities of data from several different areas. You can then utilise your findings to determine what objectives must be met so you can achieve the level of success you have your sights set on.

Once you have this information, you will select KPIs because you will know what parts of your business need improving and what measurements to set. For example, if you run a store that sells clothing for women, you have noticed that the vast majority of your profit comes from new customers instead of returning customers. You will need to set a KPI that can help you to measure the factors that influence repeat purchases. This will help you to improve this element of your business. Of course, you may be tempted to put KPIs in place for virtually all aspects of your business that you want to succeed in, but this will become too complex and difficult to manage.